How Much Do You Need for Your Down Payment?

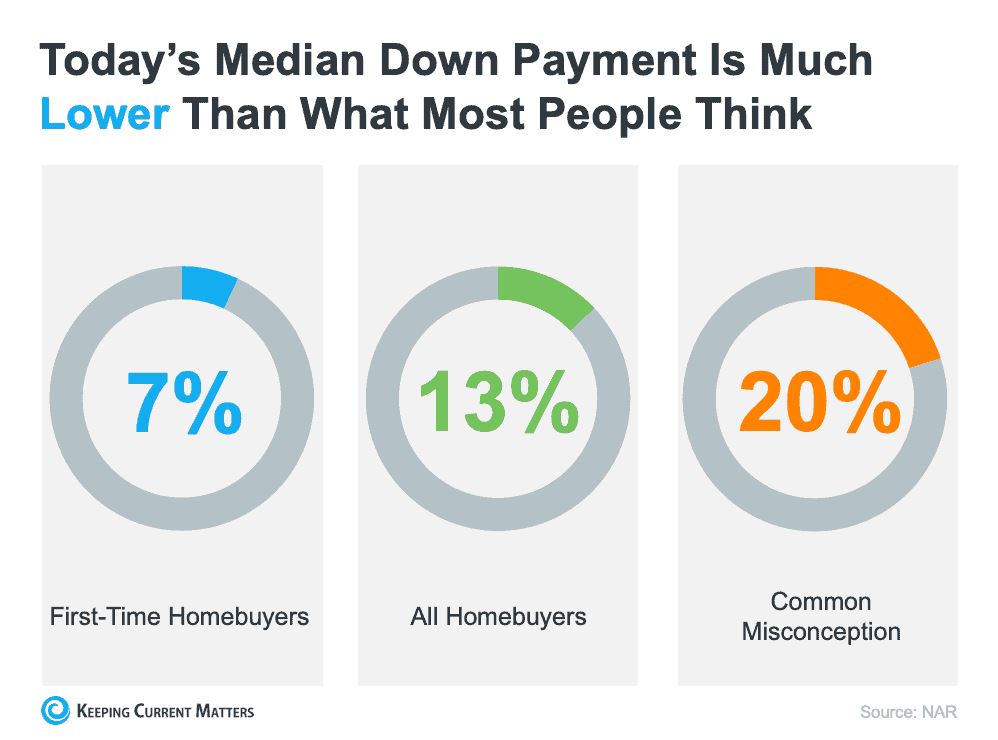

If you think you have to put 20% down, you may have set your goal based on a common misconception. Freddie Mac says:

| “The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.” |

While a down payment of 20% or more does have benefits, the typical buyer is putting far less down. That’s good news for you because it means you could be closer to your homebuying dream than you realize.

If you’re interested in learning more about low down payment options, there are several places to go. There are programs for qualified buyers with down payments as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, you need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com. Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Remember: a 20% down payment isn’t always required. If you want to purchase a home this year, reach out to a trusted real estate professional to start the conversation and explore your down payment options.

Owning a home provides one of the strongest foundations for building individual wealth and lasting financial security. If you’re ready to start your path towards homeownership, talk with a trusted real estate advisor today.

If you’re thinking of buying a home, more homes are being listed for sale, and interest rates remain at historically low rates. A trusted real estate professional can answer your questions and help you determine your next steps.

Feel free to reach out to me if you have any questions about the home buying process in the East Valley. Just give me a call/text at 602-295-6807 and I will be glad to help.

RSS Feed

RSS Feed