Make the Dream of Homeownership a Reality in 2020

If you’re dreaming of buying a home this year, the best way to start the process is to connect with a Real Estate professional to understand what goes into buying a home. Once you have that covered, then you can answer the questions below to make the best decision for you and your family.

The process of buying a home is not one to enter into lightly. You need to decide on key things like how long you plan on living in an area, school districts you prefer, what kind of commute works for you, and how much you can afford to spend.

Keep in mind, before you start the process to purchase a home, you’ll also need to apply for a mortgage. Lenders will evaluate several factors connected to your financial track record, one of which is your credit history. They’ll want to see how well you’ve been able to minimize past debts, so make sure you’ve been paying your student loans, credit cards, and car loans on time. Most agents have loan officers they trust that they can refer you to.

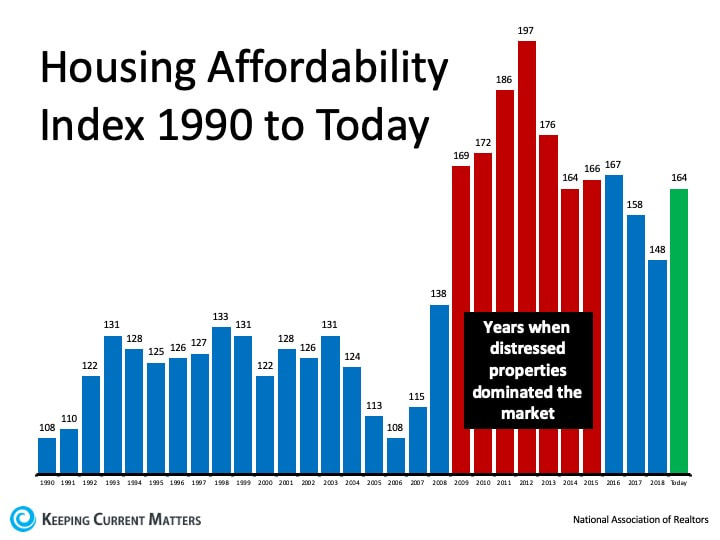

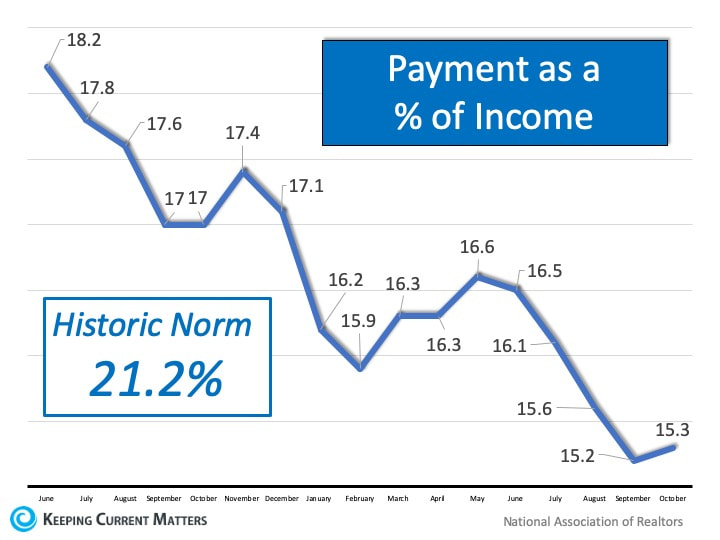

According to ConsumerReports.org,

“Financial planners recommend limiting the amount you spend on housing to

25 percent of your monthly budget.”

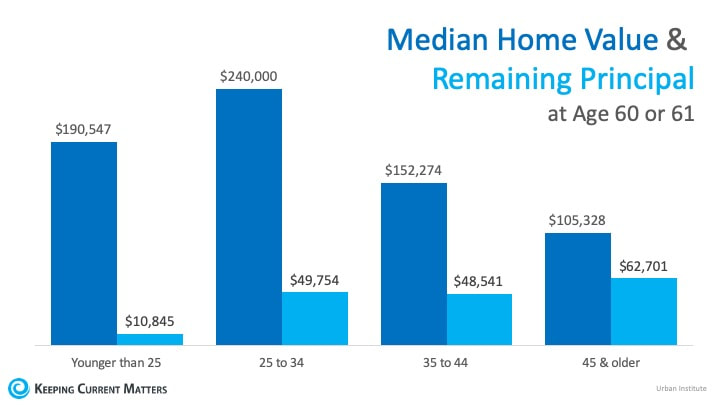

In addition to knowing how much you can afford on a monthly mortgage payment, understanding how much you’ll need for a down payment is another critical step. Thankfully, there are many different options and resources in the market to potentially reduce the amount you may think you need to put down up front.

If you’re concerned about saving for a down payment, start small and be consistent. A little bit each month goes a long way. Jumpstart your savings by automatically adding a portion of your monthly paycheck into a separate savings account or house fund. AmericaSaves.org says,

“Over time, these automatic deposits add up. For example, $50 a month accumulates to $600

a year and $3,000 after five years, plus interest that has compounded.”

Before you know it, you’ll have enough for a down payment if you’re disciplined and thoughtful about your process.

As tempting as it is to settle in each morning with a fancy cup of coffee from your favorite local shop, putting that daily spend toward your down payment will help accelerate your path to homeownership. It’s the little things that count, so start trying to live on a slightly tighter budget if you aren’t doing so already. A budget will allow you to save more for your down payment and help you pay down other debts to improve your credit score. A survey of Millennial spending shows,

“70 percent of would-be first-time homebuyers will cut spending on spa days, shopping

and going to the movies in exchange for purchasing a home within the next year.”

While you don’t need to cut all of the fun out of your current lifestyle, making smarter choices and limiting your spending in areas where you can slim down will make a big difference.

If homeownership is on your dream list this year, take a good look at what you can prioritize to help you get there. To determine the steps you should take to start the process, meet with a local real estate professional today.

Feel free to contact me if you have any questions about the home buying process, and what it takes to purchase a home in Chandler or the East Valley of Arizona.

"Real Estate is not just a job for me, it's about making a difference in the lives of others"

Troy Erickson Realtor

Call/Text: (602)295-6807

[email protected]

Facebook.com/TroyEricksonRealtor

RSS Feed

RSS Feed