Real Estate Will Lead the Economic Recovery

According to Ivy Zelman of Zelman & Associates:

“Housing will fare better than expected during this severe downturn.”

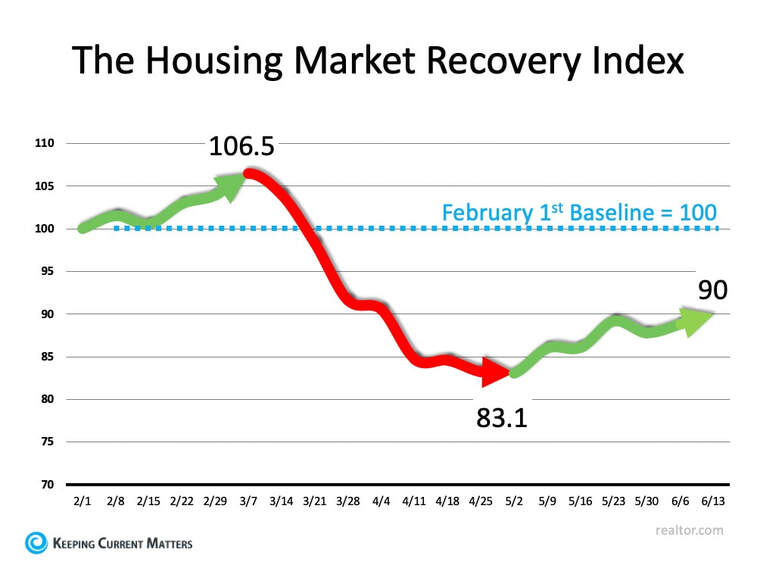

In addition, CNBC notes:

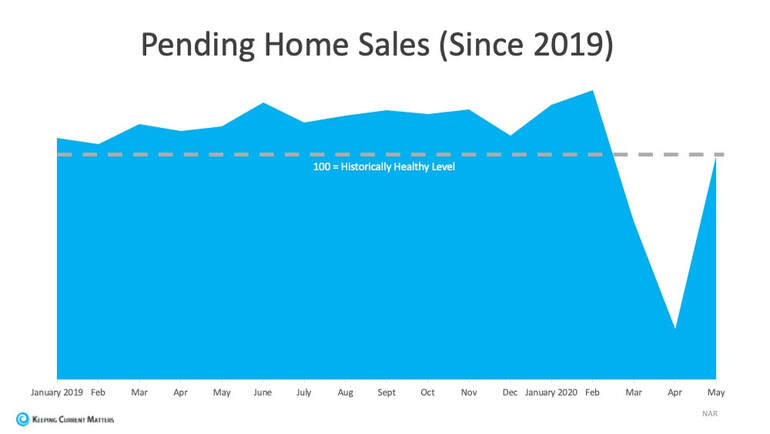

“Mortgage demand from home buyers shows unexpectedly strong and quick recovery…

The quick recovery has surprised most forecasters.”

Robert Dietz, Chief Economist and Senior Vice President for Economics and Housing Policy of the National Association of Home Builders (NAHB) says:

“Overall, the data lend evidence to the NAHB forecast that housing will be a leading

sector in an eventual economic recovery.”

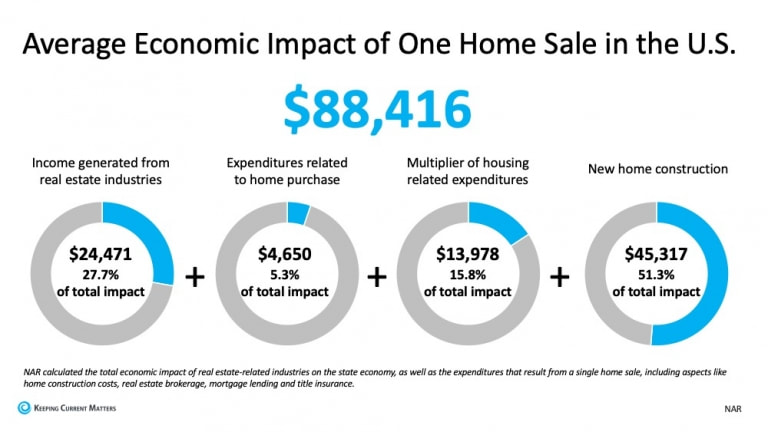

One of the big reasons why housing has the potential to be such a driving force is the significant impact it has on the local economy. This impact is particularly strong when a newly constructed home is built and sold. According to a recent study by the National Association of Realtors (NAR), the average new home sale has a total economic impact of $88,416. As outlined in the graphic below, this is a combination of income generated from real estate industries, expenditures, and new home construction.

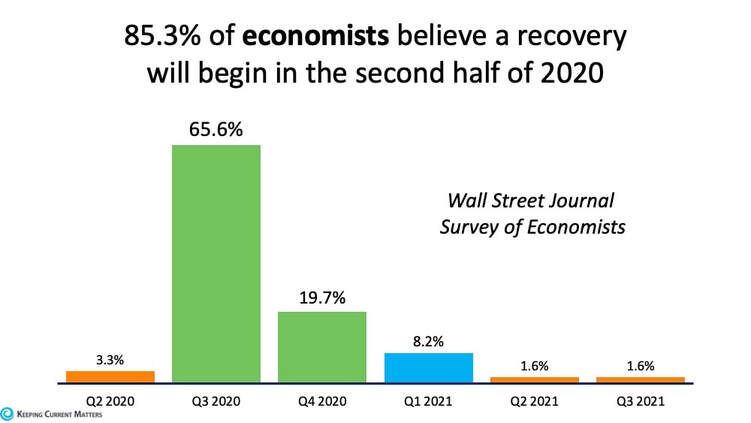

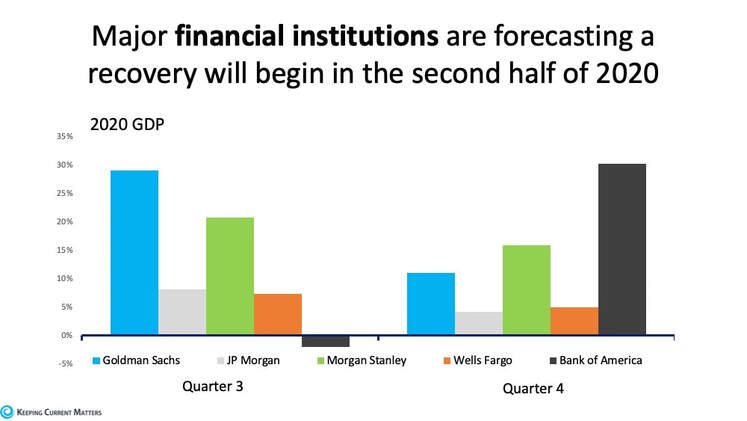

According to experts, the economy will begin to recover in the second half of this year. With real estate as a driver, that recovery may start sooner than we think.

If you’re thinking of selling, many buyers may be eager to find a home just like yours. Reach out to a local real estate professional today to make sure you can get your house in on the action this summer.

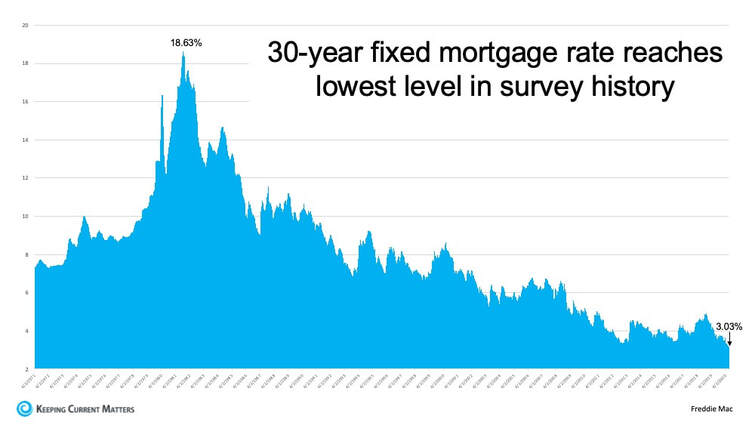

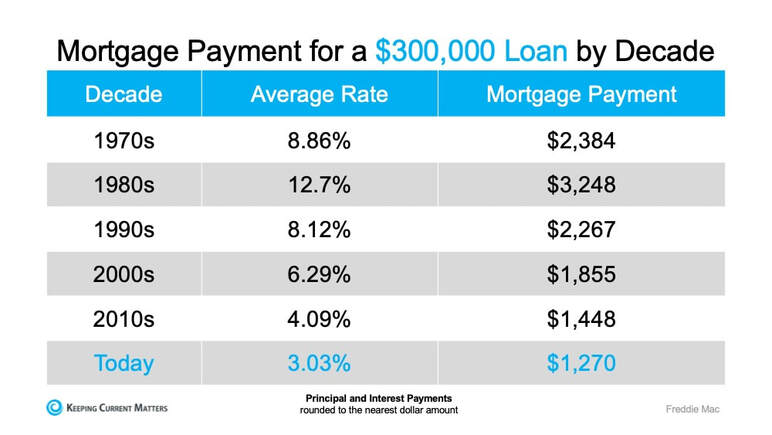

If you’re thinking of buying a home, more homes are being listed for sale, and interest rates remain at historically low rates. A trusted real estate professional can answer your questions and help you determine your next steps.

Feel free to reach out to me if you have any questions about the home buying process in the East Valley. Just give me a call/text at 602-295-6807 and I will be glad to help.

"Real Estate is not just a job for me, it's about making a difference in the lives of others"

Troy Erickson Realtor

Call/Text: 602-295-6807

[email protected]

Linkedin Profile

Facebook Page

Troy Erickson has been blogging about Arizona real estate since 2006. He is a residential real estate agent who specializes in helping home buyers, sellers, and investors in Chandler and the East Valley. He has been recognized for his local market expertise, and frequently volunteers within his community.

RSS Feed

RSS Feed