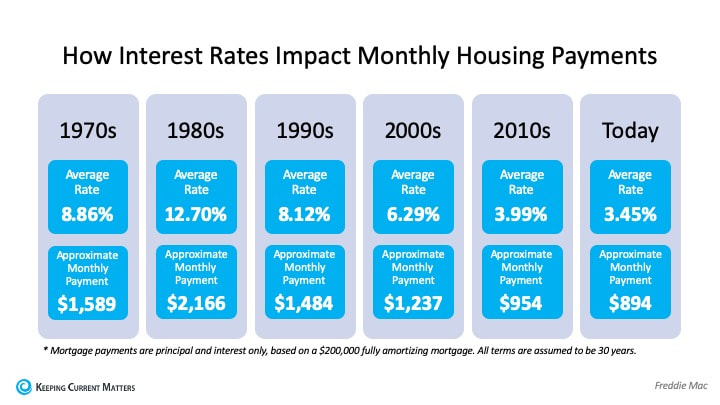

How Interest Rates Can Impact Your Monthly Housing Payments

Freddie Mac explains:

“If you’re in the market to buy a home, today’s average mortgage rates are something to

celebrate compared to almost any year since 1971…

Mortgage rates change frequently. Over the last 45 years, they have ranged from a high

of 18.63% (1981) to a low of 3.31% (2012). While it’s not likely that the average

30-year fixed mortgage rate will return to its record low, the current average rate of

3.45% is pretty close — all to your advantage.”

Keep in mind, if interest rates go up, this can push many potential homebuyers out of the market. The National Association of Home Builders (NAHB) notes:

“Prospective home buyers are also adversely affected when interest rates rise. NAHB’s

priced-out estimates show that, depending on the starting rate, a quarter-point increase in

the rate of 3.75% on a 30-year fixed rate mortgage can price over 1.3 million U.S.

households out of the market for the median-priced new home.”

If your financial situation allows, now may be a great time to lock in at a low mortgage rate to benefit greatly over the lifetime of your loan. Buying a home sooner rather than later could lead to substantial savings and long-term financial growth for you and your family.

Feel free to contact me if you have any questions about the home buying process, and what it takes to purchase a home in Chandler or the East Valley of Arizona.

Troy Erickson Realtor

Call/Text: (602)295-6807

[email protected]

Facebook.com/TroyEricksonRealtor

RSS Feed

RSS Feed